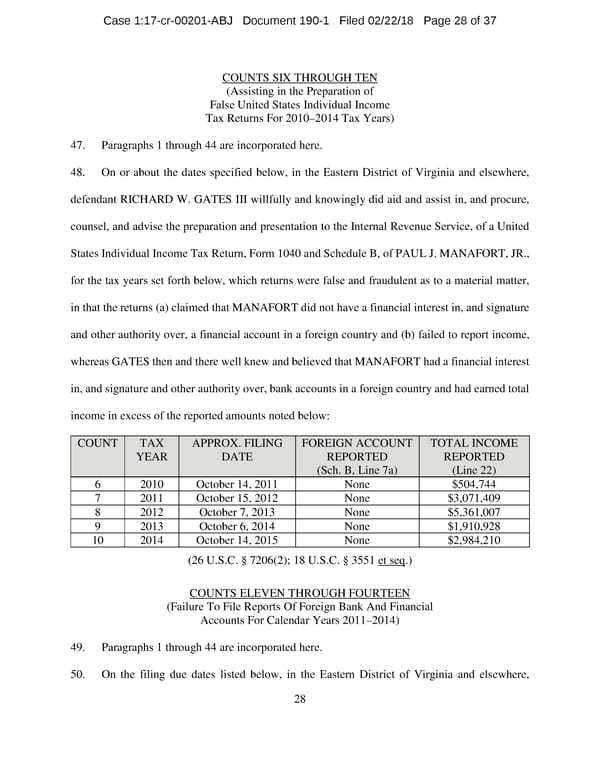

Case 1:17-cr-00201-ABJ Document 190-1 Filed 02/22/18 Page 28 of 37 COUNTS SIX THROUGH TEN (Assisting in the Preparation of False United States Individual Income Tax Returns For 2010–2014 Tax Years) 47. Paragraphs 1 through 44 are incorporated here. 48. On or about the dates specified below, in the Eastern District of Virginia and elsewhere, defendant RICHARD W. GATES III willfully and knowingly did aid and assist in, and procure, counsel, and advise the preparation and presentation to the Internal Revenue Service, of a United States Individual Income Tax Return, Form 1040 and Schedule B, of PAUL J. MANAFORT, JR., for the tax years set forth below, which returns were false and fraudulent as to a material matter, in that the returns (a) claimed that MANAFORT did not have a financial interest in, and signature and other authority over, a financial account in a foreign country and (b) failed to report income, whereas GATES then and there well knew and believed that MANAFORT had a financial interest in, and signature and other authority over, bank accounts in a foreign country and had earned total income in excess of the reported amounts noted below: COUNT TAX APPROX. FILING FOREIGN ACCOUNT TOTAL INCOME YEAR DATE REPORTED REPORTED (Sch. B, Line 7a) (Line 22) 6 2010 October 14, 2011 None $504,744 7 2011 October 15, 2012 None $3,071,409 8 2012 October 7, 2013 None $5,361,007 9 2013 October 6, 2014 None $1,910,928 10 2014 October 14, 2015 None $2,984,210 (26 U.S.C. § 7206(2); 18 U.S.C. § 3551 et seq.) COUNTS ELEVEN THROUGH FOURTEEN (Failure To File Reports Of Foreign Bank And Financial Accounts For Calendar Years 2011–2014) 49. Paragraphs 1 through 44 are incorporated here. 50. On the filing due dates listed below, in the Eastern District of Virginia and elsewhere, 28

Manafort and Gates superseding indictment Page 27 Page 29

Manafort and Gates superseding indictment Page 27 Page 29