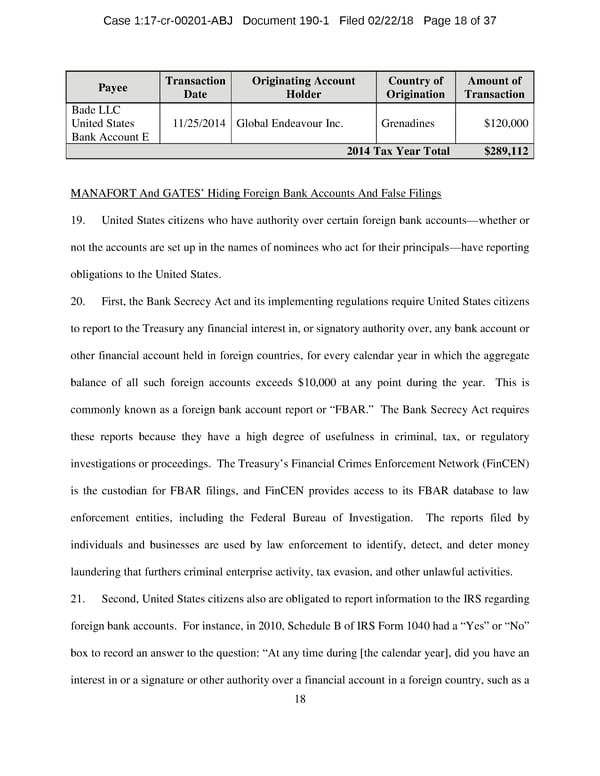

Case 1:17-cr-00201-ABJ Document 190-1 Filed 02/22/18 Page 19 of 37 bank account, securities account, or other financial account?” If the answer was “Yes,” then the form required the taxpayer to enter the name of the foreign country in which the financial account was located. 22. For each year in or about and between 2008 through at least 2014, MANAFORT had authority over foreign accounts that required an FBAR filing. Specifically, MANAFORT was required to report to the Treasury each foreign bank account held by the foreign MANAFORT– GATES entities noted above in paragraph 12 that bears the initials PM. No FBAR filings were made by MANAFORT for these accounts. 23. For each year in or about and between 2010 through at least 2013, GATES had authority over foreign accounts that required an FBAR filing. Specifically, GATES was required to report to the United States Treasury each foreign bank account held by the foreign MANAFORT– GATES entities noted above in paragraph 12 that bears the initials RG, as well as United Kingdom Bank Accounts A and B noted in paragraph 18. No FBAR filings were made by GATES for these accounts. 24. Furthermore, in each of MANAFORT’s tax filings for 2008 through 2014, MANAFORT, with the assistance of GATES, represented falsely that he did not have authority over any foreign bank accounts. MANAFORT and GATES had repeatedly and falsely represented in writing to MANAFORT’s tax preparer that MANAFORT had no authority over foreign bank accounts, knowing that such false representations would result in false tax filings in MANAFORT’s name. For instance, on October 4, 2011, MANAFORT’s tax preparer asked MANAFORT in writing: “At any time during 2010, did you [or your wife or children] have an interest in or a signature or other authority over a financial account in a foreign country, such as a bank account, securities account or other financial account?” On the same day, MANAFORT falsely responded “NO.” 19

Manafort and Gates superseding indictment Page 17 Page 19

Manafort and Gates superseding indictment Page 17 Page 19