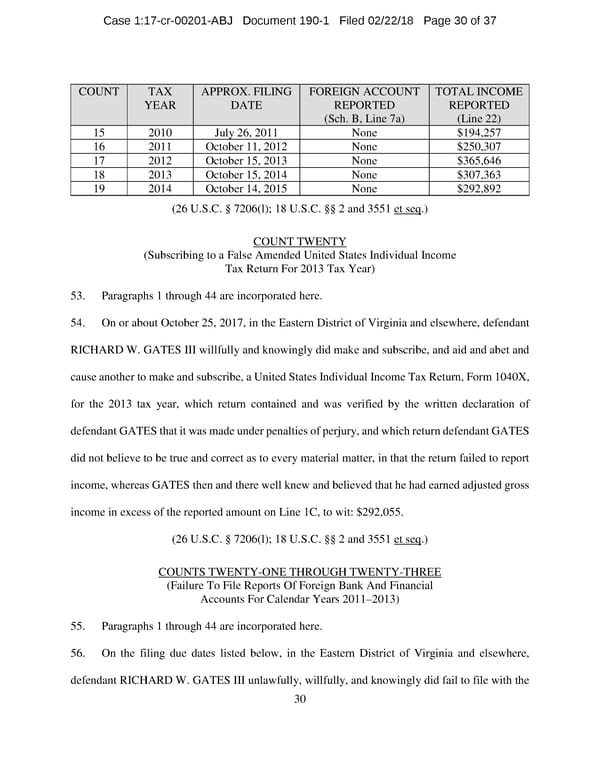

Case 1:17-cr-00201-ABJ Document 190-1 Filed 02/22/18 Page 30 of 37 COUNT TAX APPROX. FILING FOREIGN ACCOUNT TOTAL INCOME YEAR DATE REPORTED REPORTED (Sch. B, Line 7a) (Line 22) 15 2010 July 26, 2011 None $194,257 16 2011 October 11, 2012 None $250,307 17 2012 October 15, 2013 None $365,646 18 2013 October 15, 2014 None $307,363 19 2014 October 14, 2015 None $292,892 (26 U.S.C. § 7206(l); 18 U.S.C. §§ 2 and 3551 et seq.) COUNT TWENTY (Subscribing to a False Amended United States Individual Income Tax Return For 2013 Tax Year) 53. Paragraphs 1 through 44 are incorporated here. 54. On or about October 25, 2017, in the Eastern District of Virginia and elsewhere, defendant RICHARD W. GATES III willfully and knowingly did make and subscribe, and aid and abet and cause another to make and subscribe, a United States Individual Income Tax Return, Form 1040X, for the 2013 tax year, which return contained and was verified by the written declaration of defendant GATES that it was made under penalties of perjury, and which return defendant GATES did not believe to be true and correct as to every material matter, in that the return failed to report income, whereas GATES then and there well knew and believed that he had earned adjusted gross income in excess of the reported amount on Line 1C, to wit: $292,055. (26 U.S.C. § 7206(l); 18 U.S.C. §§ 2 and 3551 et seq.) COUNTS TWENTY-ONE THROUGH TWENTY-THREE (Failure To File Reports Of Foreign Bank And Financial Accounts For Calendar Years 2011–2013) 55. Paragraphs 1 through 44 are incorporated here. 56. On the filing due dates listed below, in the Eastern District of Virginia and elsewhere, defendant RICHARD W. GATES III unlawfully, willfully, and knowingly did fail to file with the 30

Manafort and Gates superseding indictment Page 29 Page 31

Manafort and Gates superseding indictment Page 29 Page 31